Share Trading App Features You Should Know About

Using technology to manage your portfolio is not optional in the fast-paced financial scene of today—it is rather necessary. With real-time insights, flawless execution, and strong security right at your fingertips, a modern share trading software can change your attitude to the markets. The correct platform will make all the difference, regardless of your level of experience trading or just starting to investigate stocks investment. Given the increasing range of choices, it’s important to know which features actually provide value and enable efficient stock purchase. This article explores the must-have features that distinguish top-tier trading applications and clarifies the reasons behind the need to select a complete stocks investment app.

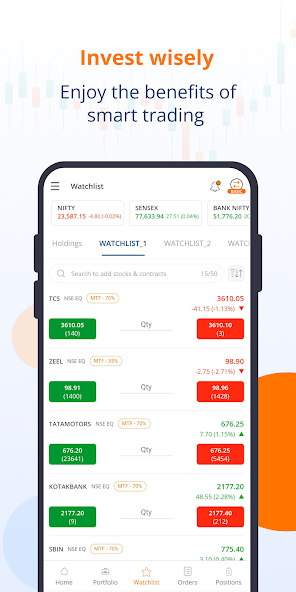

Easy-to-use interface

A strong trading tool is mostly dependent on a user-friendly interface. The tidy dashboard of your share trading app should welcome you with highlights of your portfolio performance, watchlists, and most recent market movements. Order-placing mistakes and the learning curve are lowered by intuitive navigation. Customizable layouts enable you to give the information that most counts top priority—that of account balances, news feeds, or pricing tables. Simplifying access to important data guarantees that, even in highly volatile times, an intelligent interface enables quick access to enable educated judgments.

Real-time data and sophisticated charts

Informed decision-making depends on access to advanced charting tools and real-time market data. A leading stock investment app directly from exchanges extracts live quotations, depth-of-market data, and historical trends. Interactive charts let you quickly see trends, apply technical indicators, compare several stocks, and mark patterns. Without leaving the platform, integrated news and research programs offer breaking headlines, analyst ratings, and business basics. These features enable you to keep ahead of the curve and respond confidently to changes in the market when the success of your stocks investment strategy depends on timely information.

Flexible Order Types & Effective Order Execution

Different order types and flawless order execution can greatly increase trading efficiency. Look for stop-loss, take-profit, and bracket orders to automatically manage risk outside of normal market and limit orders. Fractional share buying allows you to purchase smaller-value stocks, therefore enabling all budgets to acquire highly expensive equities. For expert traders looking for less latency, some sophisticated systems even provide direct market access (DMA). Quick, consistent performance guarantees that your trades are filled at best rates, therefore protecting your strategy from slippage and unanticipated price swings.

Educational materials and community support

Round out a complete trading solution with client service and educational materials. In-app training, webinars, and market commentary abound in many excellent stock investment apps to assist traders of all stripes. Interactive learning courses address subjects ranging from technical study to portfolio diversification. When questions develop, responsive customer service—by phone, email, or chat—ensures you get quick help. Certain sites even include social feeds or community forums where users could share tactics, talk about industry trends, and grow personally. These cooperative surroundings keep you interested and promote ongoing development.

Conclusion:

Choosing the appropriate stock trading app is about arming yourself with the tools and knowledge required for good stock investment, not only about convenience. From a simple interface and real-time data to strong security and instructional support, the tools outlined here are absolutely necessary for anyone trying to buy stocks sensibly. Giving these qualities top priority will help you to create a portfolio that will last and enable you to negotiate the markets with confidence.