Importance Of Security In The Online Trading App

The current digital era has made online trading a prevalent method for stock market and financial product trades. Internet trading platforms have attracted traders of all abilities because they are simple to use and accessible. However, online trading expansion has elevated cybercrime risks. Therefore, traders must place security as their top priority when selecting an online trading platform.

Internet trading expansion caused a surge in cyberattacks, making investors the easiest targets for hackers performing fraudulent operations. The responsibility of online trading platforms includes safeguarding user assets and personal information data.

- The platform needs solid asset protection features to prevent criminals from accessing user accounts. Online security relies on data encryption for sensitive materials, such as passwords and two-step authentication protocols.

- Protecting identity theft requires equal attention because traders need safeguarding against unauthorized access to their Social Security numbers and bank account information.

- The free trading app encrypts sensitive data through its security measures to maintain absolute confidentiality of this information.

- The security system requires users to present two proof elements during check-in procedures to boost protection.

- The platform performs standard software updates to handle security problems along with other issues.

- Real-time transaction monitoring depends on powerful algorithms through which the investment app tracks all activities in real-time while detecting unusual behavior.

- Online trading platforms and Nifty 50 apps need to implement security protocols that prevent hacking attacks, manipulation, and fraudulent activities. The investment platform uses secure servers, real-time transaction monitoring, and automated systems that detect suspicious activity.

- Cyberattack protection requires investment apps to implement extensive security solutions that feature continuous software updates, firewall protection, and antivirus capabilities.

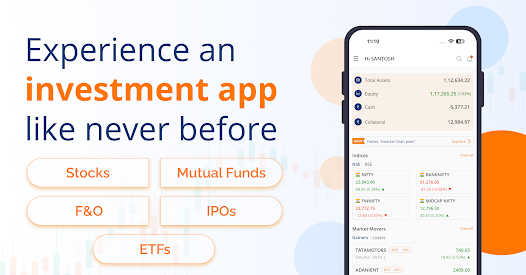

- Users need to select stock market and option trading apps with broad investment possibility options. The platform should include investment options, which include stocks alongside mutual funds and bonds, as well as options products. The platform enhances its quality as more investment options become available.

- A platform that lets you spread your investments across different assets enables you to earn more rewards while minimizing your losses. The cost structure must be carefully evaluated before picking an online trading platform. Trading platforms adopt two payment models: set trade fees or transaction percentage fees.

Security is an essential requirement for anyone who wants to invest through an online trading platform. Look for a system that offers reliable protection of your personal details and monetary data. A user-friendly platform requires security features that include data encryption, two-factor authentication, and periodic security inspections.

The selection of an online trading platform depends heavily on the quality of its customer service operations. Users should choose a platform that offers dependable and rapid customer assistance to help resolve any platform-related issues during their usage.

Security is the most important factor when selecting an online trading platform. Using a security-first approach provides traders with a dependable platform at every level of their operations. Online trading benefits become accessible to traders who make security their top priority through platform implementations that defend their money and personal details.